When central banks are net buyers of gold, the sellers typically include:

1.Gold Mining Companies: They produce new gold and sell it into the market.

2.Private Investors and Funds: Entities like hedge funds or ETFs may sell gold to realize profits or rebalance portfolios.

3.Bullion Banks: These financial institutions facilitate large-scale gold transactions and may sell gold to central banks.

4.Recycling Markets: Gold from recycled jewelry or electronics is refined and sold back into the market.

5.Other Central Banks: Some central banks may sell gold to adjust their reserves or for liquidity needs.

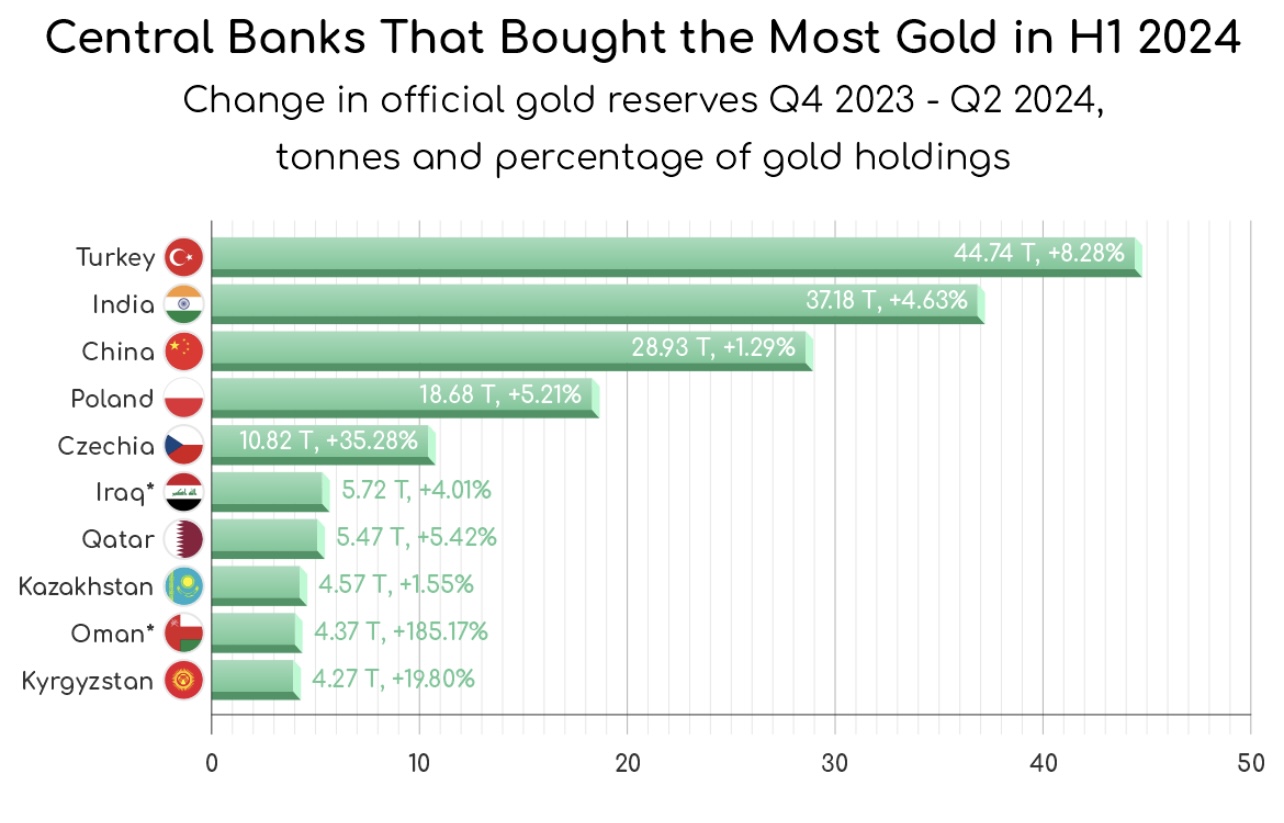

In 2025, central banks have continued to be significant buyers of gold. For instance, in Q1 2025, central banks purchased 244 tonnes of gold, maintaining a robust demand trend. Notably, the National Bank of Poland added 29 tonnes in February alone, marking its 11th consecutive month of net buying.

Conversely, some central banks have been net sellers. In February 2025, the National Bank of Kazakhstan and the Central Bank of Uzbekistan sold 8 and 12 tonnes of gold, respectively.

This dynamic between buyers and sellers contributes to the fluidity of the gold market, with various entities participating based on their individual strategies and needs.

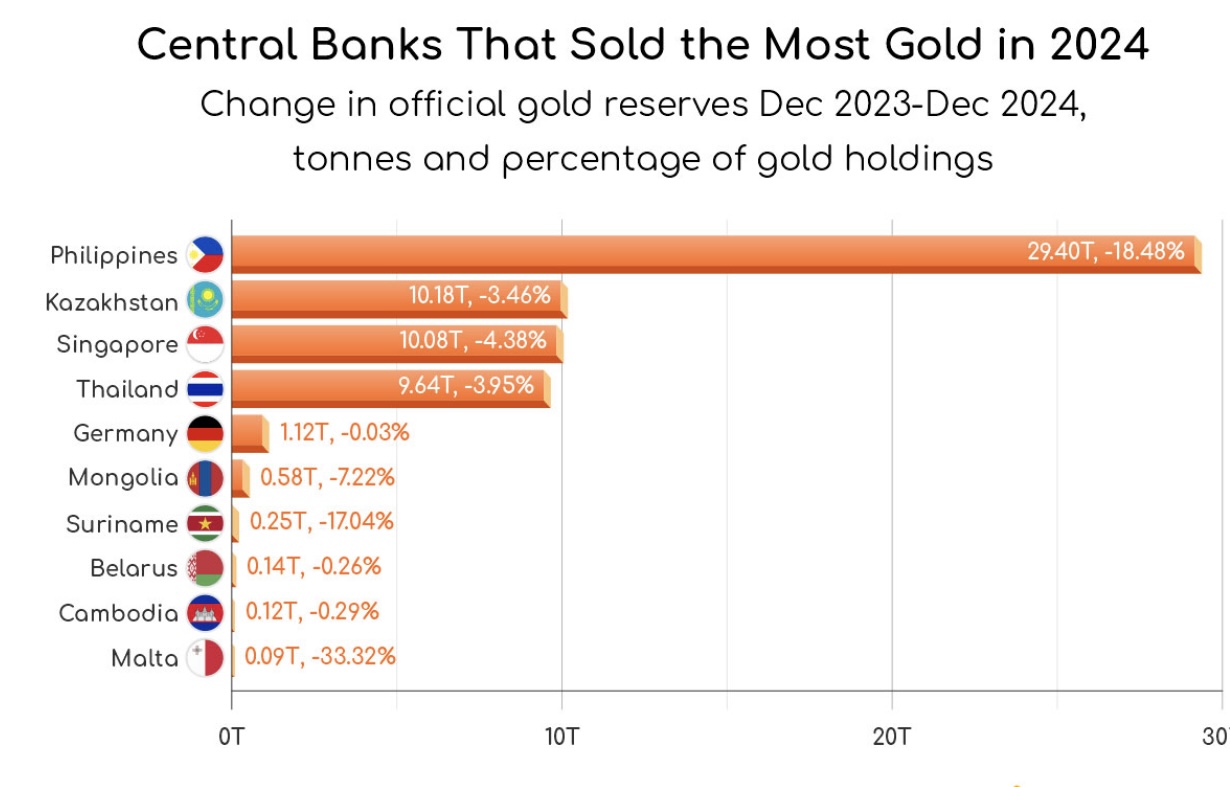

In 2024, while central banks globally were net buyers of gold, several countries engaged in notable gold sales. Here’s the top central bank gold sellers in 2024:

⸻

Top Central Bank Gold Sellers December 2023-December 2024